When you have the resources to rebuild a $30+ million home without a significant impact on your financial bottom line, what should you do regarding insurance? Natural disasters only seem to worsen year after year.

According to NOAA National Centers for Environmental Information, as of July 9, 2021, there have been 8 weather or climate events with losses exceeding $1 billion dollars in the United States. And over the last 5

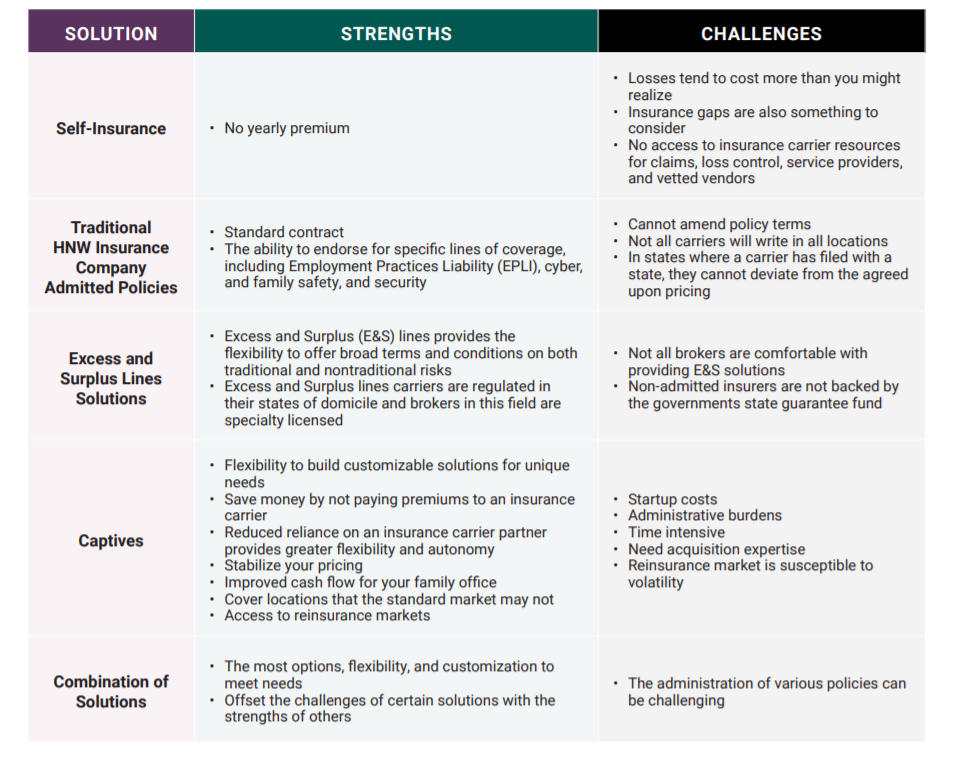

years, there have been an average of 16.2 $1-billion-dollar events per year. These trends amount to an uptick in the severity and prevalence of losses, which is why it is more important than ever before to make a holistic assessment of coverage options when building the risk management architecture for your assets and lifestyle.